FINANCIAL SUSTAINABILITY

FINANCIAL CONDITION, CASH FLOWS AND LIQUIDITY

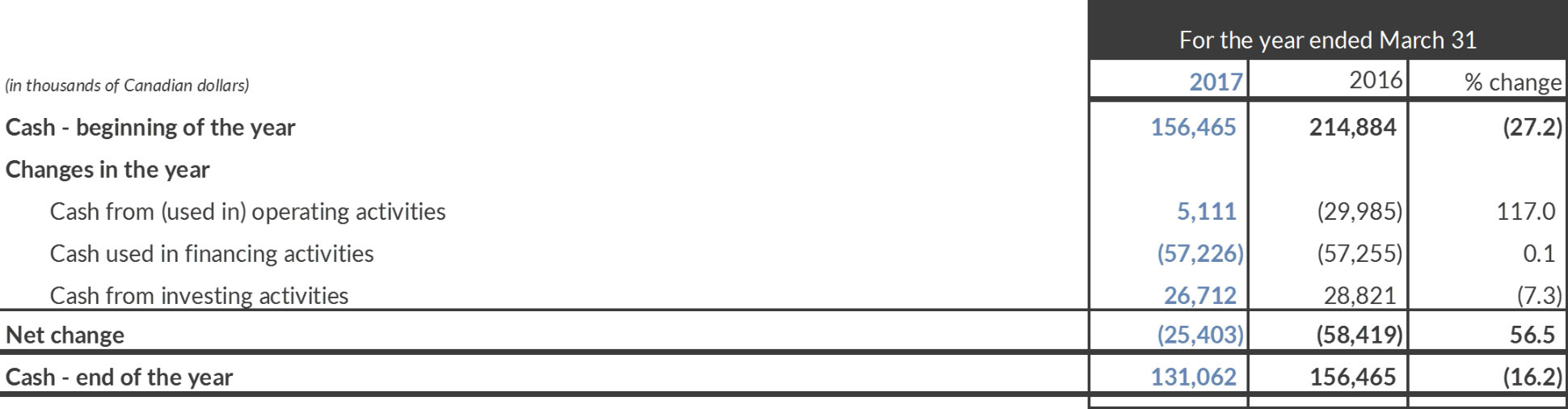

We rely on parliamentary appropriations and the cash generated from our commercial operations to fund our operating activities, including our capital needs in an environment highly dependent on technology. Specifically, our main sources of liquidity are parliamentary appropriations for operating, capital and working capital requirements, and self-generated revenue such as the sale of advertising on our various platforms. Our cash flows from operating, investing and financing activities for the year are summarized below.

Our cash balance at March 31, 2017, was $131.1 million, compared to $156.5 million on March 31, 2016.

CASH POSITION

Cash from (used in) operating activities

Cash from (used in) operating activities includes cash inflows from our drawdowns of parliamentary appropriations for operating expenditures and working capital.

Cash from operating activities was $5.1 million this year, an increase of $35.1 million compared to last year. Cash from (used in) operations is impacted each year by fluctuations in working capital. In 2015-2016, we used more cash in our operations in order to purchase additional content that is reflected in programming expenses this year.

Cash used in financing activities

Cash outflows for financing activities were stable at $57.2 million. Cash outflows for financing activities presented above relate primarily to the following:

- Interest payments of $24.6 million (2015-2016: $26.6 million);

- Repayments of the Broadcast Centre Trust bonds of $14.4 million (2015-2016: $13.4 million);

- Payments of notes payable of $6.8 million (2015-2016: $6.5 million); and

- Payments to meet obligations under finance leases of $11.5 million (2015-2016: $10.7 million).

Cash from investing activities

Cash from investing activities includes cash from our drawdowns of parliamentary appropriations for capital expenditures.

Investing activities generated cash of $26.7 million this year, compared to $28.8 million in 2015-2016. The lower net cash inflow this year was mainly due to:

- Less proceeds received from disposing of property and equipment, partly offset by lower purchases of assets; and

- Receipt of two quarterly dividends from our investment in SiriusXM, compared to four last year.

Staff from ICI Ottawa-Gatineau participate in the annual charity drive.