Accountability Plan

Our Performance - Strategy 2020

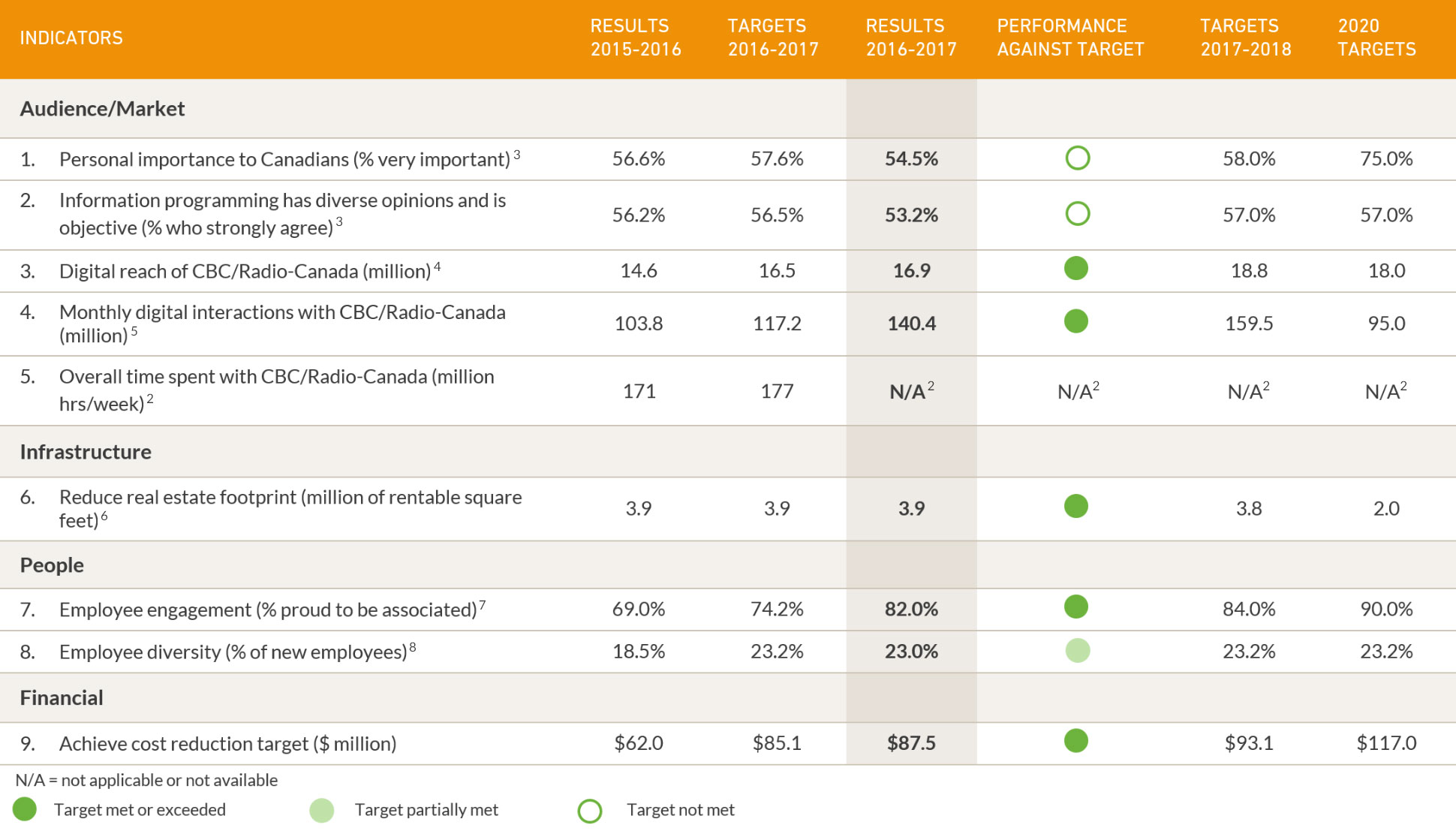

The Strategy 2020 Performance Report is used to ensure we are meeting the corporate-wide objectives of our current strategic plan. We established long-term targets we aim to meet by 2020. Each year, we track our progress towards them with short-term annual targets. Nine key indicators are used to measure the building blocks of our current strategy: audience, infrastructure, people and financial sustainability.(1)

The goal of our strategy is to increase our value to all Canadians and to deepen our relationship with them. With this in mind, four of the nine indicators measure our audience success. By 2020, we want:

- Three out of four (75%) Canadians to consider one or more of our services to be very personally important to them (indicator 1);

- Canadians to continue to strongly agree that CBC/Radio-Canada's information programming reflects a diversity of opinions and covers issues in a fair and balanced way (indicator 2); and

- To increase our digital reach so that 18 million Canadians will use our digital platforms each month and to grow the number of digital interactions they have with our services (indicators 3 and 4).

To support our audience goals, we will need to transform our infrastructure, including reducing our real estate footprint by 50% (indicator 6).(2) We will also need our employees to be more engaged (indicator 7) and to better reflect the diverse society we serve (indicator 8). We are aiming to achieve these objectives while becoming more financially sustainable through cost reductions (indicator 9).

Our performance metrics are evolving as the media industry continues to undergo a digital transformation. Canadians consume media content on multiple devices (e.g. smartphones, tablets, smart TVs) from an ever growing array of content providers. As media consumption habits change, audience measurement suppliers and the Corporation are refining methodologies and introducing new measurement technologies to ensure the accuracy and completeness of data gathered. Since some of these data are used to measure our strategic and operational performance, we may be required to make adjustments to targets and historical results to enhance comparability of the data.

Audience/Market – CBC/Radio-Canada's digital reach (indicator 3) increased throughout the year, surpassing its 2016-2017 target with nearly 17 million Canadians turning to CBC/Radio-Canada's digital offerings, more than ever before. Monthly digital interactions (indicator 4) exceeded its 2016-2017 target, driven by the success of our coverage of the Rio 2016 Olympics and the U.S. presidential election.

An overall softening in Canadians' perceptions was observed this year as both survey indicators (1 and 2) performed below their 2016-2017 targets and prior year results. That being said, results are still positive with close to 6 Canadians out of 10 who strongly believe that CBC/Radio-Canada is personally important to them (indicator 1). In fact, according to the 2016 Ipsos brand study, CBC/Radio-Canada continues to be recognized as Canada's most influential media company.(9) Also of note for the future, we will continue to closely monitor the perception towards CBC/Radio-Canada's information programming (indicator 2) as repeated discussions and spread of fake news on social media could influence how Canadians perceive information programming in general.

Infrastructure – Our real estate footprint (indicator 6) met its target for 2016-2017. A sizeable reduction in our real estate footprint is expected following the sale of the existing Maison de Radio-Canada and the move into a new leased facility, currently scheduled for fiscal year 2019-2020.

People – Employee engagement (indicator 7) surpassed its annual target by almost eight percentage points, driven by significant improvements in organizational climate and work environment.

Employee diversity (indicator 8) saw a significant increase in 2016-2017 with CBC/Radio-Canada almost achieving its target. In the fourth quarter, we reached our best performance since launching the indicator due to an acceleration in the pace of new diverse hires. While close to reaching our target, we will continue our increased focus on diversity and inclusion in order to attract a broader pool of external candidates and improve retention and advancement of diverse employees to include an increasing range of faces, voices, experiences and perspectives in our workplace.

Financial – Cost reductions (indicator 9) exceeded target for 2016-2017.

NEW PERFORMANCE INDICATORS

Two additional performance indicators have been chosen to measure the incremental impact of the government's reinvestment on two key areas of interest – expanding our digital presence and increasing services to local markets.

Our performance metrics are evolving as the media industry continues to undergo a digital transformation. Canadians consume media content on multiple devices (e.g. smartphones, tablets, smart TVs) from an ever growing array of content providers. As media consumption habits change, audience measurement suppliers and the Corporation are refining methodologies and introducing new measurement technologies to ensure the accuracy and completeness of data gathered. Since some of these data are used to measure our strategic and operational performance, we may be required to make adjustments to targets and historical results to enhance comparability of the data.

Additional monthly digital (#1) and local service (#2) interactions with CBC/Radio-Canada: Overall, we had a strong digital performance and exceeded our 2016-2017 incremental growth targets. For our main sites (indicator 1), we outperformed our expectations with more Canadians visiting our sites more often. Local digital services (indicator 2) also exceeded incremental growth expectations, although in a smaller proportion. We will continue to monitor these key performance indicators closely in the future.

(1) As of 2016-2017, the indicator for Investment Fund (formerly indicator 10) is no longer relevant due to the government’s reinvestment in CBC/Radio-Canada. It will not be included in the Strategy 2020 Performance Report.

(2) Indicator 5 - Overall time spent with CBC/Radio-Canada. This indicator measured time spent across our TV, radio, and digital platforms. In fall 2016, Numeris introduced a change in its radio survey methodology by offering respondents the option to report their listening hours with an online diary instead of a traditional paper diary. Numeris recognizes that this methodological enhancement has significantly affected results in the Anglophone markets. Our radio results form a material portion of this indicator. Therefore, time spent results for 2016-2017 are not comparable to our target or prior year figures. In addition, the ongoing digital transformation of the media industry has reduced the ability of this indicator to measure the performance of our services across platforms. As a result of this latter change, this measure is being removed from the Strategy 2020 Performance Report.

(3) Source: Mission Metrics Survey, TNS Canada. This is the percentage of Canadians who give us top marks (i.e. 8, 9 or 10 on a 10-point scale). Information programming (Indicator 2) is the average of two questions: CBC/Radio-Canada's information programming "reflects a diversity of opinions on a wide range of issues" and "covers major issues in a fair and balanced way".

(4) Source: Unduplicated reach of CBC and Radio-Canada digital platforms. comScore, multiplatform measurement, monthly average unique visitors.

(5) Source: comScore, multiplatform measurement, monthly average visits.

(6) Our rentable square feet (RSF) results exclude: foreign offices (e.g. bureaus), transmission sites, parking lots and leases for the sole purpose of storage (i.e. no broadcasting activity).

(7) Source: Gallup Consulting, Dialogue 2016 Survey. This is the percentage of employees who are proud to be associated with CBC/Radio-Canada. This is measured as the percentage of employees who responded four to five on a scale of one to five in a representative survey of employees.

(8) This metric is made up of three groups: Indigenous peoples, persons with disabilities and visible minorities. It is calculated as a percentage of new external hires for positions of 13 weeks or more.

(9) Source: Ipsos: The Most Influential Brands in Canada, 2016. In 2016, CBC and Radio-Canada both ranked as the most influential media brand in their market (across all categories, CBC ranked #11 in English Canada and Radio-Canada ranked #8 in Quebec).

(10) Source: comScore, multiplatform measurement, monthly average visits.

(11) Source: comScore, multiplatform measurement, monthly average visits; Adobe SiteCatalyst, monthly average visits.