Results and Outlook

Summary – Net Results

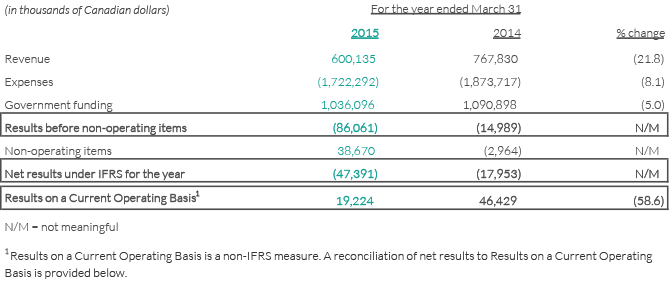

IFRS Results

| (in thousands of Canadian dollars) | For the year ended March 31 | ||

| 2015 | 2014 | % change | |

| Revenue | 600,135 | 767,830 | (21.8) |

| Expenses | (1,722,292) | (1,873,717) | (8.1) |

| Government funding | 1,036,096 | 1,090,898 | (5.0) |

| Results before non-operating items | (86,061) | (14,989) | N/M |

| Non-operating items | 38,670 | (2,964) | N/M |

| Net results under IFRS for the year | (47,391) | (17,953) | N/M |

| Results on a Current Operating Basis1 | 19,224 | 46,429 | (58.6) |

N/M = not meaningful 1 Results on a Current Operating Basis is a non-IFRS measure. A reconciliation of net results to Results on a Current Operating Basis is provided below. |

|||

Results on a Current Operating Basis remained positive in 2014-2015 as cost reduction initiatives helped offset the decline in revenue and funding. The decrease in revenue this year was due to two main factors. First, prior year results include advertising revenue from our February 2014 broadcast of the Sochi Olympic Winter Games. In addition, this year marked the first year in which we did not have advertising revenue for a full year of broadcasting Hockey Night in Canada (HNIC), following the end of our contract with the NHL in June 2014. A weaker advertising market relative to last year also contributed to a lesser extent to the decline in revenue. These decreases were partly offset by higher revenue generated from our coverage of the 2014 FIFA World Cup Brazil last summer.

While our production spending associated with the broadcast of last year’s Sochi 2014 Winter Olympics and hockey games also notably decreased in 2014-2015, we have been successful in reducing other operating expenses through cost management initiatives. Together, these decreases led to a reduction in our expenses of $151.4 million (8.1%) compared to the prior year. These reductions were partly offset by severance costs associated with the workforce initiatives announced during the year and the production costs incurred to broadcast the 2014 FIFA World Cup Brazil. These cost-reduction initiatives now provide us with a balanced budget for 2015-2016, which responds to the lower revenue base following the end of our NHL contract, the changes in the broadcasting industry, and our lower level of government funding.

Government funding recognized for accounting purposes was $54.8 million (5.0%) lower in the current year. This primarily reflects the lower levels of government appropriations received of $45.5 million and lower capital funding recognized for accounting purposes of $8.5 million this year following the implementation of initiatives to reduce our asset base.

Net results reflected a loss of $47.4 million for the year, compared with a loss of $18.0 million in the prior year. In addition to revenue, expenses and government funding, this year’s results include non-operating gains of $38.7 million, mostly from a gain on the sale of Sirius XM Canada Holdings Inc. (SiriusXM) shares for $33.5 million. Included in net results for both years are items that do not currently generate or require funds from operations, as explained on the following page.

Jeun'Info – ICI Radio-Canada.ca

Reconciliation of net results under IFRS to Results on a Current Operating Basis

CBC/Radio-Canada defines Results on a Current Operating Basis as Net Results under IFRS less the adjustments for non-cash expenses that will not require operating funds within one year and non-cash revenues that will not generate operating funds within one year. This measure is used regularly by management to help monitor performance and balance the Corporation’s budget consistent with parliamentary appropriations. We believe this measure provides useful complementary information to readers, while recognizing that it does not have a standard meaning under IFRS and will not likely be comparable to measures presented by other companies.

Adjustments include the elimination of non-cash pension and other employee future benefit costs, which represent the excess of the IFRS expense over the actual cash contribution for the year. Adjustments are also made for other non-cash items such as the depreciation, amortization and decommissioning of capital assets; the amortization of deferred capital funding; and non-budgetary annual leave. Other less significant items not funded or generating funds in the current period, primarily employee-benefit-related, are adjusted for in the reconciliation to Results on a Current Operating Basis.

Results on a Current Operating Basis amounted to a gain of $19.2 million this year, a decrease of $27.2 million when compared to last year. This decrease primarily reflected lower revenue and lower government funding recognized in income this year, consistent with the last instalment of our share of reductions announced in Federal Budget 2012.

| (in thousands of Canadian dollars) | For the year ended March 31 | ||

| 2015 | 2014 | % change | |

| Net results under IFRS for the year | (47,391) | (17,953) | N/M |

| Items not generating or requiring funds from operations | |||

| Pension and other employee future benefits | 45,813 | 58,799 | (22.1) |

| Depreciation, amortization and decommissioning expenses, net of amortization of deferred capital funding | 23,473 | 16,452 | 42.7 |

| Other provisions for non-cash items | (2,671) | (10,869) | (75.4) |

| Results on a Current Operating Basis | 19,224 | 46,429 | (58.6) |

| N/M = not meaningful | |||

SUMMARY – TOTAL COMPREHENSIVE INCOME (LOSS)

| (in thousands of Canadian dollars) | For the year ended March 31 | ||

| 2015 | 2014 | % change | |

| Net results under IFRS for the year | (47,391) | (17,953) | N/M |

| Other comprehensive income | 187,457 | 203,812 | (8.0) |

| Total comprehensive income for the year | 140,066 | 185,859 | (24.6) |

| N/M = not meaningful | |||

In addition to pension costs included in net results, quarterly remeasurements of our pension and other future employee benefit plans resulted in other comprehensive income of $187.5 million this year. This was due to non-cash remeasurements resulting from changes in actuarial assumptions and returns on pension plan assets. More information on these remeasurements is included within Note 16 of our Consolidated Financial Statements.