FINANCIAL SUSTAINABILITY

YEAR IN REVIEW – OUR RESULTS

SEASONALITY AND QUARTERLY FINANCIAL INFORMATION

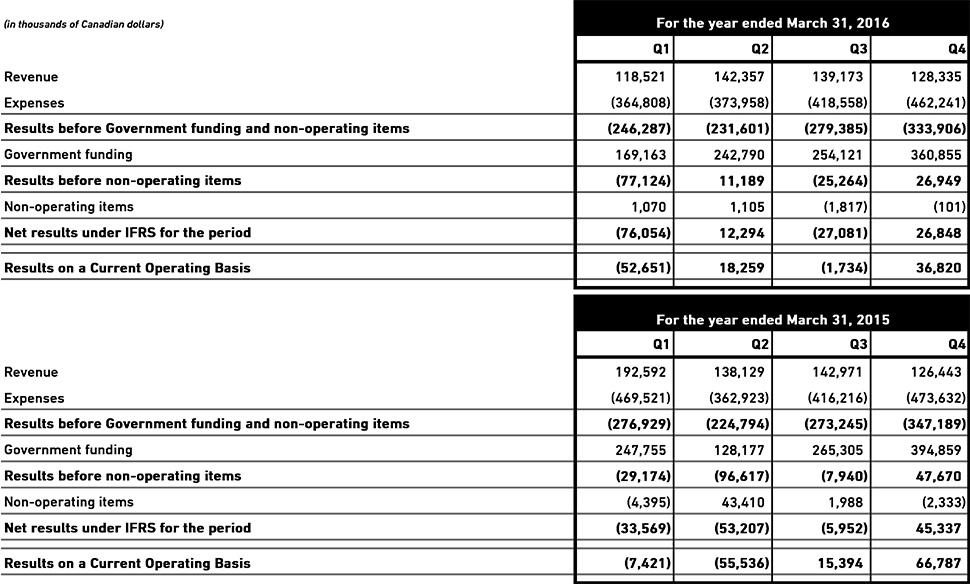

The following table shows condensed financial data for the previous eight quarters. This quarterly information is unaudited, but has been prepared on the same basis as the annual consolidated financial statements. We discuss the factors that caused our results to vary over the past eight quarters within this management discussion and analysis.

|

Our operating results are subject to seasonal fluctuations that materially impact quarter-to-quarter operating results.

Revenue generated during the second quarter of the year is usually at its lowest level because the summer season attracts fewer viewers. In contrast, revenue in the third quarter is comparably higher as audiences are larger and more advertisers purchase airtime in anticipation of the holiday season.

Expenses also tend to follow a seasonal pattern because they are influenced by the programming schedule. Operating costs tend to be higher in the fourth quarter as the Corporation incurs costs preparing for the fall broadcasting season and completes project deliverables due by the end of the fiscal year.

Historically, revenue and expenses in the first quarter of each financial year were typically higher due to our coverage of NHL playoffs. With the end of CBC’s contract with the NHL in 2014-2015, the seasonality of our revenue is becoming more reflective of general market, economic and viewership patterns affecting all conventional broadcasters.

Government funding is recognized in the Corporation’s income based on budgeted net expenses for the quarter. Monthly and quarterly budgets are established from the annual budget approved by the Board of Directors at the beginning of each year, and reflect expected appropriation funding for the year and seasonal impacts on expenditures and self-generated revenue.

Other factors may impact net results from quarter to quarter. These may include foreign exchange gains or losses, changes to the fair value of derivative financial instruments, asset write-offs and sales. When appropriate, these are recorded as non-operating items. As indicated in the table, the Corporation recorded lower levels of non-operating gains and losses in 2015-2016 compared to 2014-2015, mostly explained by the gain of $33.5 million from the sale of a portion of our investment in SiriusXM recorded in the second quarter of 2014-2015.

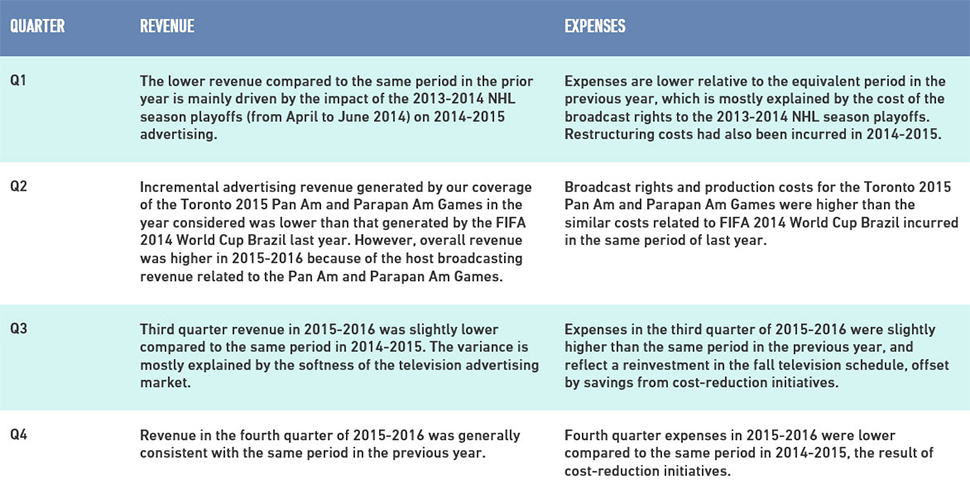

Comparison of 2015-2016 and 2014-2015 by Quarter

|

Strategy 2020 performance metrics

|

Rick Mercer with students from Macville Public School in Caledon, Ontario, Rick Mercer Report, CBC Television

(1) As of 2016-2017, the investment fund target indicator is no longer required due to the Government’s reinvestment in CBC/Radio-Canada, and will not be included in the Strategy 2020 Performance Report.