FINANCIAL SUSTAINABILITY

YEAR IN REVIEW – OUR RESULTS

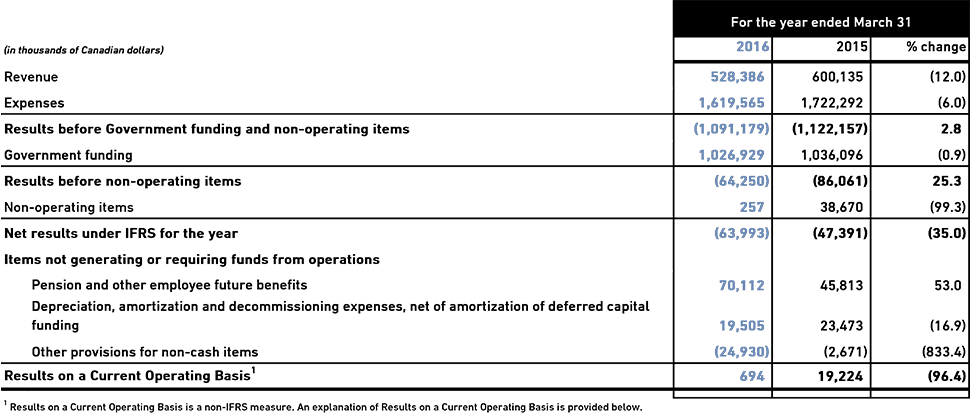

results under ifrs and on a current operating basis

The following analysis provides a more detailed discussion of our financial performance.

|

Net Results under IFRS for the Year

Net results under IFRS for the year were a loss of $64.0 million, greater than the loss of $47.4 million incurred in 2014-2015. The decrease this year is due in large part to the proceeds of $33.5 million included in 2014-2015 results following the sale of our interest in SiriusXM.

Our Results before non-operating items exclude, among other things, the gain on SiriusXM recorded last year. This measure illustrates the improvement in our results achieved this year relative to 2014-2015. Results before non-operating items increased by 25.3% ($21.8 million) due to:

- Lower operating expenses more than offsetting revenue decreases. While our production spending associated with the broadcast of events decreased this year, we have also been successful in reducing our ongoing operating expenses through cost-reduction initiatives. These savings are allowing us to reinvest in our content. In addition, we incurred some event costs this year as we covered the Toronto 2015 Pan Am and Parapan Am Games.

- Government funding levels remaining consistent with 2014-2015.

Included in Net results under IFRS for the period are items that do not currently generate or require funds from operations, as explained below.

Results on a Current Operating Basis

Results on a Current Operating Basisamounted to a gain of $0.7 million this year, a decrease of $18.5 million when compared to last year. This result is close to break even, consistent with management’s objective to balance the Corporation’s budget. Last year’s Results on a Current Operating Basis of $19.2 million included proceeds from the sale of some of our equity interest in SiriusXM.

CBC/Radio-Canada defines Results on a Current Operating Basis as Net Results under IFRS less the adjustments for non-cash expenses that will not require operating funds within one year and non-cash revenues that will not generate operating funds within one year. This measure is used regularly by management to help monitor performance and balance the Corporation’s budget consistent with parliamentary appropriations. We believe this measure provides useful complementary information to readers, while recognizing that it does not have a standard meaning under IFRS and will not likely be comparable to measures presented by other companies.

Adjustments include the elimination of non-cash pension and other employee future benefit costs, which represent the excess of the IFRS expense over the actual cash contribution for the year. Adjustments are also made for other non-cash items such as the depreciation, amortization and decommissioning of capital assets; the amortization of deferred capital funding; and non-budgetary annual leave. Other less significant items not funded or generating funds in the current period, primarily employee-benefit-related, are adjusted for in the reconciliation to Results on a Current Operating Basis.