FINANCIAL SUSTAINABILITY

FINANCIAL CONDITION,

CASH FLOW AND LIQUIDITY

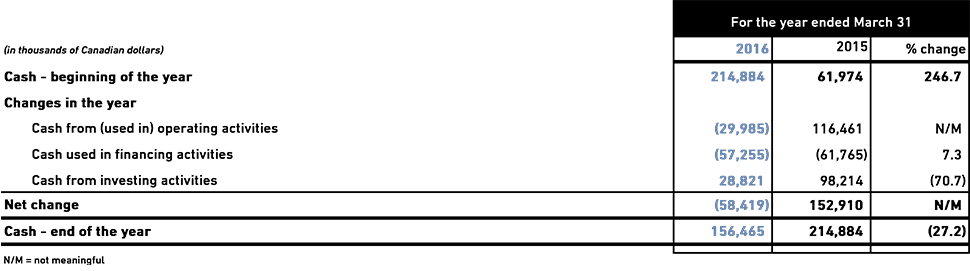

We rely on parliamentary appropriations and the cash generated from our commercial operations to fund our operating activities, including our capital needs in an environment highly dependent on technology. Specifically, our main sources of liquidity are parliamentary appropriations for operating, capital and working capital requirements, and self-generated revenue such as the sale of advertising on our various platforms. Our cash flows from operating, investing and financing activities for the year are summarized below.

Our cash balance at March 31, 2016, was $156.5 million, compared to $214.9 million on March 31, 2015. Last year’s cash balance reflected several one-time receipts, including the proceeds from the sale of a portion of our equity interest in SiriusXM Canada Holdings Inc. (SiriusXM) and collections on advertising revenue following our broadcast of the Sochi 2014 Olympic Winter Games.

Cash Position

|

CASH FROM (USED IN) OPERATING ACTIVITIES

Cash used in operating activities was $30.0 million this year, a decrease of $146.4 million compared to last year. Cash from (used in) operations is impacted each year by fluctuations in working capital, and 2015-2016 saw a $67.7 million increase in our short-term programming inventory, mostly as a result of prepayments for the Rio 2016 Olympic Games. We had also generated additional cash in operations in 2014-2015, the largest source being collections on advertising revenue following our broadcast of the Sochi 2014 Olympic Winter Games and the 2013-2014 NHL season playoffs.

Cash used in financing activities

Cash outflows for financing activities were $57.3 million, lower than last year by $4.5 million, as a result of cash used in February 2015 to settle our remaining obligations under finance leases for mobile and office equipment and to purchase the related assets.

Other cash outflows for financing activities in both years presented above relate to:

- interest payments;

- repayments of the Toronto Broadcast Centre bonds;

- payments of notes payable; and

- payments to meet obligations under our satellite transponder finance leases.

Cash from investing activities

Investing activities generated cash of $28.8 million this year, compared to $98.2 million in 2014-2015. The higher cash inflows last year were mostly attributable to:

- The receipt of $33.5 million in net proceeds from the July 2014 sale of a portion of the shares we hold in SiriusXM; and

- Dividends received of $16.9 million from our remaining investment in SiriusXM (compared to $5.5 million in 2015-2016).

Acquisition of property and equipment was higher this year, as a result of the consolidation of our locations in both Halifax and Moncton, the relocation of our station in Sudbury, and HD upgrades to our production facilities in Ottawa and Quebec City.

Keeping Canada Alive, CBC Television