ABOUT US

OUR OPERATING ENVIRONMENT

A public broadcaster with unique characteristics

Of CBC/Radio-Canada’s total revenue in 2015-2016:

- 66% is government funding

- 16% is from advertising

- 9% is from subscriptions

- 9% is from other sources

CBC/Radio-Canada has a hybrid funding model and competes for audiences and decreasing advertising revenue in the Canadian media market, while also being accountable to the Broadcasting Act for additional language and content requirements. However, like all broadcasters, both in Canada and internationally, we are in the process of adjusting to the dramatic digital shift that is occurring in the consumption habits of audiences. The exception, of course, is that Canada is bilingual and we are therefore conducting this shift in both official languages.

CBC/Radio-Canada has two principal sources of revenue: parliamentary appropriations and self-generated revenues. Up until the end of this fiscal year, funding from government appropriations had decreased in real-dollar terms (adjusted for inflation) over the last 25 years. However, in March, the new federal government announced that the public broadcaster would receive an important reinvestment: an additional $75 million in 2016-2017 and $150 million per year on an ongoing basis. This funding will be reflected in our financial statements starting in the 2016-2017 fiscal year.

Media consumption habits are changing

The Internet, and the technology advances that are evolving with it, brings a profound change in media habits. Canadians spend an average of 21 hours a week on the Internet, with over 70% of that time spent with audio or video content, rather than with text and still images.(1) Content is increasingly being consumed via mobile devices, with 75% of Canadians owning a smartphone and 54% owning a tablet.(1) By comScore’s estimates, online services receive more than 1.1 billion visits per month that originate from a mobile device in Canada.(2) On top of this, the Internet has provided new ways for Canadians to interact with one another. The majority of Canadians (70%) are now social networking: six in ten are doing it daily and 57% are doing it via a mobile device.(1)

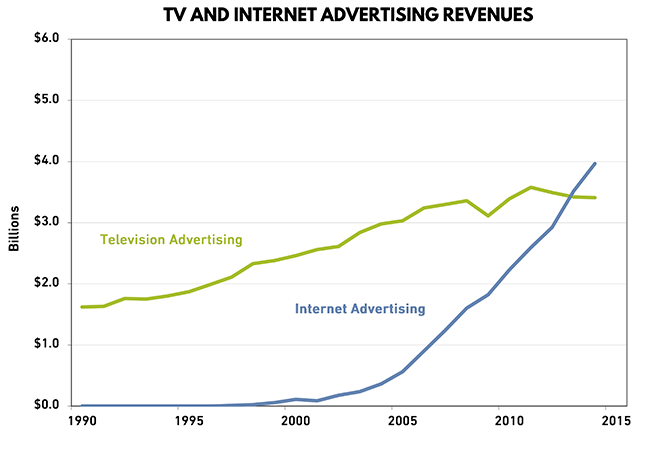

The consumer habits mentioned above have created a profound shift in the advertising market that has negatively affected the outlook for traditional media companies like CBC/Radio-Canada. Internet has replaced television as the largest advertising medium in Canada.(3) This has a significant impact on the Corporation since we do not compete in close to 60% of Internet advertising categories (i.e. search, classified), limiting revenue growth that might otherwise be expected.(4)

This fiscal year, the Canadian Radio-television and Telecommunications Commission’s (CRTC’s) decisions resulting from the Let’s Talk TV hearings, including the introduction of small basic, pick-and-pay options and genre protection elimination, came into effect. Since March 1, 2016, all distributors offer a “skinny” basic package at $25 per month, with additional options of pick-and-pay channels. While increasing choice for consumers, as of mid-April there has only been limited take-up of this option (approximately 100,000 Canadians, according to the CRTC).

It is expected that the subscription market will become more competitive, compounded by the fact that subscribers are increasingly moving towards Over the Top (OTT) online subscription services such as Netflix, Shomi and CraveTV. CBC/Radio-Canada’s subscriber base is expected to be impacted as they become more competitive.

Our evolving regulatory environment

Besides these important market challenges, our regulatory environment is also about to undergo significant change.

On September 14, 2015, the CRTC launched a review of the policy framework for local and community television programming. This review builds on the determinations made during the Let’s Talk TV proceeding. The Commission is reviewing issues related to policy, regulation and funding of local programming. No new funding will be provided, but existing funding may be reallocated among broadcasting initiatives to help strengthen local programming. Given the importance of this proceeding for us, we filed written comments and appeared at the public hearing in January 2016.

During the fall of 2015, the Canada Media Fund (CMF) conducted cross-country public consultations about its future. CBC/Radio-Canada's recommendation was that CMF should continue its excellent work by continuing to focus on its core mandate – the financing of Canadian content. We strongly emphasized that CMF should not dilute its strong focus on content financing by investing in other unrelated areas such as technology or production infrastructure. In March 2016, CMF released its 2016-2017 program budget and guidelines, which continued CMF's Canadian content financing focus. At that time, CMF also indicated that they would continue to respond to the industry's changing needs moving forward. As always, given the importance of CMF financing to the Canadian programming that CBC/Radio-Canada brings to Canadians, we will closely monitor any contemplated changes to CMF's focus.