MESSAGES YEAR

MESSAGES YEARIN REVIEW RESULTS

AND OUTLOOK RESOURCES FINANCIAL

REPORTING GOVERNANCE PERFORMANCE About

Risk Management and Key Risk Table

As Canada’s national public broadcaster, CBC/Radio-Canada occupies an important place in the Canadian broadcasting system and faces a unique set of risks to its plans and operations. Like all broadcasters, we must adapt to technological changes, shifts in demographics and evolving consumer demands, as well as structural changes in the industry. As a public broadcaster with a statutory mandate to deliver a wide range of programming in order to serve all Canadians, we also face unique public expectations, financial challenges and risks.

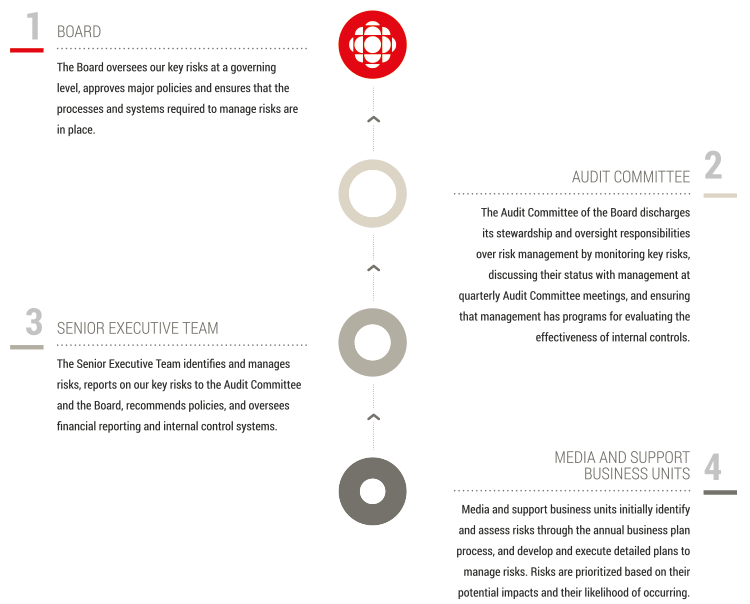

Our Risk Management Program is part of an enterprise-wide approach integrated into business processes. Responsibility for risk management is shared among our Board of Directors, the Board’s Audit Committee, the Senior Executive Team and operational units.

Internal Audit plans its audits in accordance with the results of the risk assessment process and provides assurance that major risks are covered on a rotational basis by the annual audit plan.

The following table discusses the key risks faced by CBC/Radio-Canada during fiscal 2013—2014 and the ongoing impact into 2014—2015.

Key Risks |

Risk Mitigation |

Future Impact |

1. Renewed Strategy – Beyond 2015 |

||

Developing a strategic roadmap beyond 2015 is important because the Corporation has limited financial flexibility in an environment characterized by a shift from traditional television to specialty television and other platforms, rapid technology evolution, loss of professional hockey rights and industry consolidation and fragmentation. |

The development of a new strategic plan, already underway, has been accelerated. Our next strategic plan will take a more focused approach to appealing to audiences and becoming the public broadcaster of tomorrow. This will include making realistic assessments of what we’re doing now, what we need to do in the future and how we will pay for it. |

Continue with strategic planning development phase into 2014—2015. This new strategic framework, which we will announce in the coming months, will guide the Corporation’s evolution towards a more nimble and more open public broadcaster. It will ensure that the services we provide, and the operating model that supports those services, evolve in tandem with the changing expectations of Canadians and the movements of our industry. |

2. Budget Concerns |

||

CBC/Radio-Canada is faced with financial challenges ranging from an industry-wide softening of the advertising market, disappointing schedule performance for some individual prime-time programs in key demographics on CBC Television, much lower-than-expected ad revenues from ICI Musique and

CBC Radio 2, and the NHL’s decision to move to a single, exclusive broadcaster. These reductions are in addition to significant pressures already managed by the Corporation since |

To balance the 2014—2015 budget, we had to make cuts of $130 million and the equivalent of 657 positions over the next two years. Ongoing management and review of the initiatives implemented to ensure expected outcomes are achieved. |

Planning process underway to assess our options following the expiry of the four year deal. |

3. Hockey Contract Effect |

||

CBC’s broadcast and digital rights contract with the NHL ended in June of 2014. The NHL has opted to award the national broadcast and digital rights to Rogers Communications Inc. under an exclusive On November 25, 2013, the Corporation reached an agreement with Rogers Communications Inc. (Rogers) for the continued airing of Hockey Night in Canada (HNIC) on Saturday night and during the playoffs, beginning with the 2014—2015 hockey season. This arrangement between CBC/Radio-Canada and Rogers includes the following elements:

|

As part of the 2014—2015 budget announcements, extensive organizational changes have been announced for the Sports and Revenue Group areas to address the impact of the loss of the hockey contract. Ongoing management and review of the initiatives implemented to ensure expected outcomes are achieved. |

Planning process underway to assess our options following the expiry of the four-year deal. |

4. Union Relations |

||

A. Section 18.1 Radio-Canada Union Consolidation |

||

A long-term strategy for more operational flexibility from our Radio-Canada unions in a different working environment. |

Continue the process before the Canada Industrial Relations Board (CIRB) to review the existing structure of the French Services' bargaining units with a view to consolidating the unions. |

Hearings before the CIRB are continuing and a decision on the bargaining structure is expected in 2014. |

B. Contract Expiries |

||

Excess space and infrastructure affects operations and budgets. |

Continue to reinforce business needs in terms of flexibility and ensure that collective bargaining reflects these needs. Involve unions in discussions relating to economic challenges and encourage input into managing risks. Successfully negotiate with remaining unions or negotiate wage re-openers pending decision on bargaining structure of unions in French Services. Ensure communications activities are identified and implemented with union leaders before launching business strategies and initiatives. |

Identified strategies will continue into 2014—2015. |

5. Infrastructure Replacements and Optimization |

||

Excess space and infrastructure affects operations and budgets. |

We are continuing our plan to reduce our overall real estate footprint. In the shorter term, we will pursue the sale of some CBC/Radio-Canada-owned buildings and shifting from owner to tenant and look to lease our vacant space in the remaining buildings. |

We have begun the next phase of our redevelopment initiative for our Montreal facility. Requests for Proposals for the Maison de Radio-Canada Project were issued to pre-qualified Proponents in June 2013 and responses are expected in 2014—2015. |

6. Regulatory Issues |

||

A. Channel Carriage |

||

(i) CBC/Radio-Canada is the only major television broadcaster in Canada without corporate distribution affiliations. There is a concern that carriage terms offered by Broadcast Distribution Undertakings (BDUs) will favour their own affiliated specialty services at the expense of our specialty services. Risks to the Corporation include BDUs dropping our existing television services that are not mandatory carriage, delaying the launch of new specialty services or decreased revenue from BDUs for carrying our specialty television services. |

Strategic discussions with BDUs focusing on overall value of the programming services offered, and negotiation of long-term agreements with terms that protect or enhance current carriage and revenues. |

Continue with identified strategies into 2014—2015. |

(ii) CRTC Television Policy On October 24, 2013 the CRTC launched a three-phase consultation with Canadians about the future of television in Canada (BNI CRTC 2013-563). On November 7, 2013, the government asked the CRTC to produce a report by April 30, 2014 on how Canadians can be provided with the greatest ability to obtain TV services on a pick-and-pay basis while meeting the objectives of the Broadcasting Act (PC 2013-1167). On April 25, 2014, the CRTC launched the third phase of its proceeding. The public hearings will be held in September 2014. Areas that will be explored include changes to packaging intended to foster choice and flexibility, changes to the system to promote Canadian content and changes to permit Canadians to make informed choices and provide recourse in the case of disputes with their service providers. |

Monitor developments as more information on the CRTC’s proposed changes is made available during phase three of its consultation. Assess the potential ramifications to Participate in the CRTC’s Television Policy proceeding. |

CBC/Radio-Canada will monitor developments and address as required. |

(iii) CRTC Targeted Commercial Radio Review (BNC CRTC 2013-572) On October 30, 2013 the CRTC launched a two-phase consultation on a number of specific elements of the current regulatory framework for the commercial radio sector. |

Assess the potential ramifications to |

The Corporation expects that any changes the CRTC may make with respect to the advertising regime for commercial radio broadcasters may be taken into consideration by the CRTC when it conducts its 2016 review of the conditions of licence permitting CBC Radio 2 and ICI Musique to broadcast advertising. CBC/Radio-Canada will monitor developments and address as required. |

B. Music Rights, Royalties and Tariffs |

||

Renewal of key music rights deals with copyright holders may impact revenues and our service strategy. Copyright collectives are seeking new or increased tariffs on music performing and music reproduction rights. Royalty payment methods must take into account that the business model is shifting toward the multiplatform delivery of works. |

Continue proactive relationship building with all music rights holders to renew on mutually acceptable terms. Continue to negotiate with collectives. Appeal to the Supreme Court of Canada on the decision concerning the Society of Reproduction Rights of Authors, Composers and Publishers in Canada (SODRAC). |

Continue with identified strategies into 2014—2015. |

C. Terms of Trade with Independent Television Producers |

||

Negotiations on terms of trade (rights, contribution, other business terms) for independently-produced programming continue. CBC/Radio-Canada is required by Condition of Licence (COL) to enter into Terms of Trade agreements with the Canadian Media Production Association (CMPA) and Association québécoise de la production médiatique (AQPM) The terms of trade will affect the cost of independent programs. |

Continue discussions to narrow issues of disagreement. Assess potential for independent third-party mediation, as needed. Assess possibility of applying to amend the COL, as needed. |

Neither terms of trade agreement will meet the May 28, 2014 COL timeframe. CBC and CMPA have agreed to private mediation to commence in Fall 2014. We are still exploring options on how to move forward with AQPM. |

D. Canada Media Fund (CMF) |

||

CMF rule changes or changes to how the CMF allocates funds to broadcaster performance envelopes could result in narrower program rights and/or higher contributions required from |

Proactively advance our position with the CMF, including participation in the CMF National Focus Group |

CMF released the 2014—2015 Performance Envelope results to broadcasters on April 2, 2014. CBC and Radio-Canada’s Performance Envelopes decreased by $7.4 million, or $5.2 million and $2.2 million respectively. Continue with identified strategies into 2014—2015. Develop and implement contingency plans to offset financial impact. |